The changes to tax relief announced in Budget 2024 mean that you and your employees will have more take-home pay in your pocket from July 2024, with around 1.9 million households benefiting by $60 per fortnight on average.

How much will you save from this Budget’s tax package?

To find out how much you or your family will save, the NZ Government released a Budget Tax Calculator.

The Budget 2024 Tax Calculator factors in the changes to the tax thresholds, IECT, changes to NZ Super, working for families and the new FamilyBoost for early childhood education.

Many taxpayers will welcome the increased income tax thresholds so they have more funds available for spending and savings. Be aware that you may need to contact your employer, bank or chartered accountant to make the most of your tax savings.

For those in business, is your payroll system ready for the changes to personal income tax (PIT) rates?

What the main PIT changes?

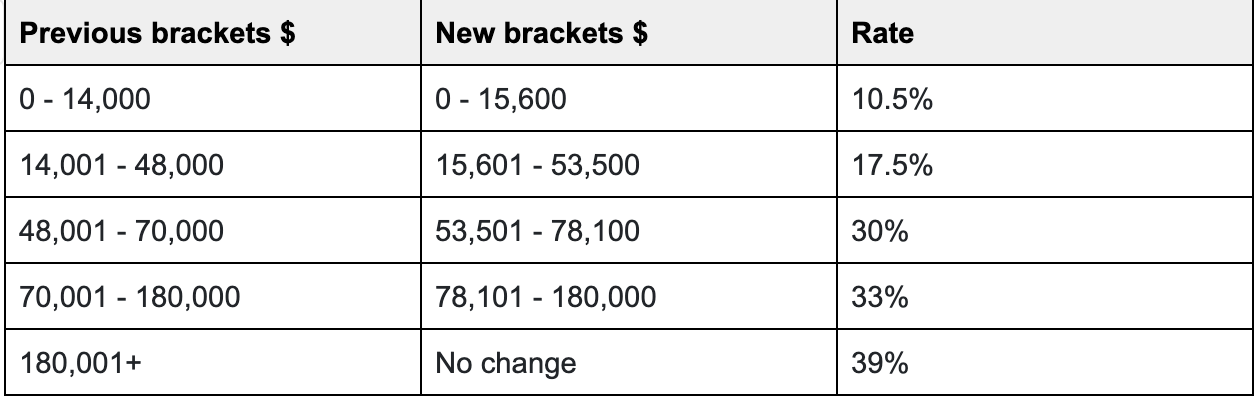

Income tax brackets have changed as of 31 July 2024, with the thresholds increasing to $15,600, $53,500 and $78,100 per annum. In real terms, this means that employees will keep more of their pay, but it also means that your payroll set-up must reflect these changes.

Four of the five income tax brackets have been amended, as shown in this table:

Is your payroll system is ready to use the new income brackets?

If you’re using one of the major payroll software platforms, such as Xero Payroll or Smartly etc., your PIT income brackets should have been automatically updated. Check with your provider to ensure that calculations are being made with the new income brackets.

If you work out your payroll manually, you’ll need to update your calculation tables and formulas and input the new brackets as shown in the table above.

Talk to us about streamlining your payroll processes

If managing and updating your payroll system is getting to be a chore, talk to us about how we can help make the process easier.